Credit: JCRules via Wikimedia Commons

In the wake of recent revelations of widespread tax evasion by government officials and others, observers have emphasized the human rights concerns raised by lost tax revenue and secrecy in financial transactions. These funds, in particular, could have been used to lessen inequality and to advance the realization of economic, social, and cultural rights in countries around the world. [CESR] As governments join in an international inquiry, human rights experts have reiterated their calls for States to ensure transparency in the workings of financial institutions and their intermediaries. [Guardian: Inquiry]

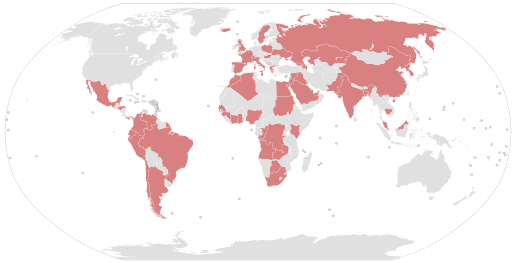

On April 2, 2016 the International Consortium of Investigative Journalists (ICIJ) revealed the Panama Papers, more than 11.5 million documents exposing how some of the world’s most powerful people concealed their wealth or avoided taxes by invoking the services of a Panama-based law firm, Mossack Fonseca, specializing in the use of offshore financial structures. Among those implicated are 140 international politicians and public officials, business leaders, celebrities, sports stars, and individuals subject to international sanctions for supporting rights-abusing regimes in countries such as Syria and North Korea. [ICIJ; Guardian: Panama Papers] Notably, the prime minister of Iceland was forced to step aside after the files revealed he and his family hid an offshore investment company with claims on Iceland’s failed banks, and the records exposed the offshore companies of several other leaders, including from Pakistan, Ukraine, and Saudi Arabia. [ICIJ; Guardian: Offshore]

Since the publication of the Panama Papers, the international community has weighed in on the human rights implications of tax evasion and other illicit financial activities. The United Nations Independent Expert on foreign debt and human rights recently urged the international community to end financial secrecy and curb the flow of illicit financial flows that deprive governments’ resources needed for the realization of human rights. [UN News Centre] The Independent Expert had already published a report on the topic of illicit financial flows, human rights, and development in February 2015 and recently added to it with a January 2016 report on the same topic, and the International Bar Association published a report in April 2015 that offers a rights-based analysis of tax evasion issues such as those brought to light in the Panama Papers. The reports suggest that illicit financial activities hold negative implications for the realization of human rights because they limit the resources available for rights promoting programs, undermine efforts to eradicate poverty, enable the activities of international criminals who partake in rights-abusing activities, and perpetuate economic and political inequality among people and countries.

Independent Expert on Foreign Debt: Illicit Financial Flows and Human Rights

In his report to the Human Rights Council in January 2016, the Independent Expert on the effects of foreign debt on human rights, Juan Pablo Bohoslavsky, focused on tax evasion and its implications for human rights, complementing his 2015 report that reviewed a variety of ways in which illicit financial flows undermine development and fuel global disparities in the enjoyment of human rights. See Human Rights Council, Final study on illicit financial flows, human rights and the 2030 Agenda for Sustainable Development of the Independent Expert on the effects of foreign debt and other related international financial obligations of States on the full enjoyment of all human rights, particularly economic, social and cultural rights, UN Doc. A/HRC/31/61, 15 January 2016 (hereinafter, Final study on illicit financial flows).

The Independent Expert asserts that tax evasion denies governments resources necessary to provide programs that give effect to economic, social, and cultural rights and to build and strengthen the structures and institutions necessary to uphold civil and political rights. See id. at para.50.

The Independent Expert reiterated this idea in his April statement, declaring:

Tax evasion destroys trust in public institutions and the rule of law, and shrinks the fiscal space for investing in public health care, education, social security and other public goods and services. Public funds that are essential to guarantee economic, social and cultural rights to all are robbed from the people.

The Independent Expert has also recognized that developing countries are most impacted by illicit financial activities, noting in his April 8, 2016 statement that illicit financial outflows from developing and emerging economies related to tax evasion, crime, corruption and other illicit activities amounted to an estimated US $1.1 trillion in 2013. [OHCHR Press Release] In his recent report, the Independent Expert goes on to emphasize that States’ economic, social, and cultural obligations include seeking and providing international assistance, which in turn includes international cooperation on curbing tax evasion. See Final study on illicit financial flows, paras. 40-42.

Government Accountability and Economic Inequality

The Independent Expert further warns that tax abuse can impact the rights to equality and freedom from discrimination. Governments’ failure to address tax abuses works to the benefit of those wealthy enough to afford the process of evading taxes and, as a result, disproportionate tax burdens and regressive taxes fall hardest on the poor. This trend often disproportionately affects women. The report warns that unequal distribution of economic burdens may result in the denial of basic rights for some groups of people. See id. at paras. 24-30.

The Independent Expert also highlights that tax evasion threatens the rule of law when States allow it to occur with impunity and that human rights defenders deserve protection in exposing tax abuse. Respect for human rights and due process guarantees is essential to protect whistleblowers, journalists, and other human rights defenders who provide information on ongoing tax evasion. See id. at para. 21.

Human Rights Obligations: Who are the Duty-Bearers?

While the responsibility to develop and enforce tax regimes that promote and comply with human rights standards falls solely to the State, the Independent Expert argues that corporations that implement “aggressive tax planning” must recognize the human rights implications and demonstrate respect for human rights guarantees. See id. at para. 56. States, the report further comments, in accordance with the UN Guiding Principles on Business and Human Rights, must protect against human rights abuses in their jurisdiction, including those perpetrated by businesses and must set out expectations for the behaviour of businesses. See id. at para. 57. Building on these claims with his recent statement, the Independent Expert calls for legally binding international standards requiring public disclosure of beneficial ownership information. [OHCHR Press Release]

Report of the International Bar Association

In a 2015 report, the International Bar Association’s Human Rights Institute Task Force provides a comprehensive rights-based analysis of the negative human rights impacts of tax abuses. See IBA, Tax Abuses, Poverty and Human Rights, International Bar Association: A Report of the International Bar Association’s Human Rights Institute Task Force on Illicit Financial Flows, Poverty and Human Rights (2015). The report takes a multidimensional view of poverty as a concept that implicates a vast array of human rights, including the rights to life and physical integrity, equal protection before the law, access to justice and effective remedies, and the right to an adequate standard of living. See id. at 89, 110. The report highlights that tax avoidance contributes to global poverty by depriving governments of the resources needed to combat poverty and fulfill human rights. This may include depriving programs related to health, education, housing, access to justice and an adequate standard of living of sufficient funds. See id. at 2, 93.

The report also recognizes the intersecting nature of tax policy and inequality, asserting that tax systems serve to represent, create, and perpetuate fundamental imbalances of power and wealth. See id. at 88-89. These systems influence trends in global wealth distribution, which, as outlined in the report, have tended to channel a higher and higher percentage of the global household income to the world’s wealthiest population to the detriment of the poorest. See id. at 88. The report asserts that unfair tax strategies that are technically legal within domestic legal systems, such as those employed by Mossack Fonseca, are nonetheless immoral and unjustifiable. See id. at Executive Summary.

As discussed in the report of the Independent Expert, this report also emphasizes that tax abuses result in economic flows out of developing countries that exceed the inflows of development assistance; therefore, tax abuses in developed countries can contribute to perpetuating extreme poverty and human rights violations in developing countries. Further, the report assesses that, in light of tax evasion, strong tax governance is necessary to enable developing countries to reduce reliance on foreign development assistance and instead look to domestic resource mobilization to eradicate poverty. See id. at 89-91

Critiques of Tax Evasion as a Human Rights Issue

The report also points out that to paint tax avoidance as a human rights issue remains contentious. Many stakeholders consulted in the development of the report noted the difficulty in establishing direct connections between tax evasion and human rights violations. It was stated that, in order to do so, there would need to be substantial evidence that the revenue lost to tax avoidance would have otherwise been spent on social programs to improve people’s rights. However, others stated that a human rights analysis was important to understanding the intersectional nature of human rights, financing for development, and taxes. See id. at 96.

Relevant Human Rights Obligations of States

International Covenant on Economic, Social and Cultural Rights

The reports of both the Independent Expert on Foreign debt and the International Bar Association make reference to Article 2 of the International Covenant on Economic, Social and Cultural Rights (ICESCR), which requires States to work to progressively to achieve the full realization of economic, social, and cultural rights, using the maximum of its available resources. The IBA report asserts that because tax abuse reduces the resources available for government allocation for the progressive realization of economic, social, and cultural rights, States have the obligation to advance effective legislative, institutional and international cooperation measures to combat abusive tax practices. See id. at 106.

Of those countries whose leaders and their close inner circles were tied to offshore financial activities by the Panama Papers (including Pakistan, Iraq, Ukraine, Saudi Arabia, Azerbaijan, China, and Russia), all except Saudi Arabia have ratified the ICESCR and are thus obliged to maximize available resources for the progressive realization of rights under Article 2. [ICIJ; Guardian]

Extraterritorial obligations of States in the area of Economic, Social, and Cultural Rights

The IBA report also asserts that the human rights implications of tax avoidance present a challenge regarding States’ extraterritorial obligations. Citing the Maastricht Principles, a document created by experts in international law that outlines the extraterritorial obligations of States under existing international human rights mechanisms, the report indicates that governments must create an international enabling environment conducive to the universal fulfillment of relevant rights and to regulate the human rights impacts of business entities whose parent company or main centers of business are domiciled in the State concerned. As discussed in the Independent Expert’s report, tax avoidance is a cross-border issue. In this light, the report asserts, there is a need for a common framework of international cooperation and assistance to combat international tax abuse. See id. at 110.

Additional Information

Other civil society groups have weighed in on the human rights implications of illicit financial activity. For example, the Business and Human Rights Resource Centre has reported on a case in which a company seeking rights to an oil field in Uganda used the services of Mossack Fonseca to avoid paying US$ 400 million in taxes. As a third of people living in Uganda make less than US$ 1.25 a day, and where US $400 million is more than the country’s annual health budget, such a large amount of additional funds in tax revenue could potentially have a major impact on the realization of human rights in the country. [Business and Human Rights Resource Centre]

For more information on economic, social, and cultural rights, visit IJRC’s Online Resource Hub.